Hi, my name is Colton Smith and I have a passion for investigating and exploiting financial phenomena from the perspective of a data scientist.

While working at Imbue Capital, I have built out a cutting-edge research pipeline for developing quantitative trading strategies that implements the best practices in financial machine learning including labeling techniques, feature engineering and extraction, model selection, cross-validation methods, model interpretability, and portfolio construction. We have used this pipeline to run systematic commodities strategies and aid global macro discretionary trading.

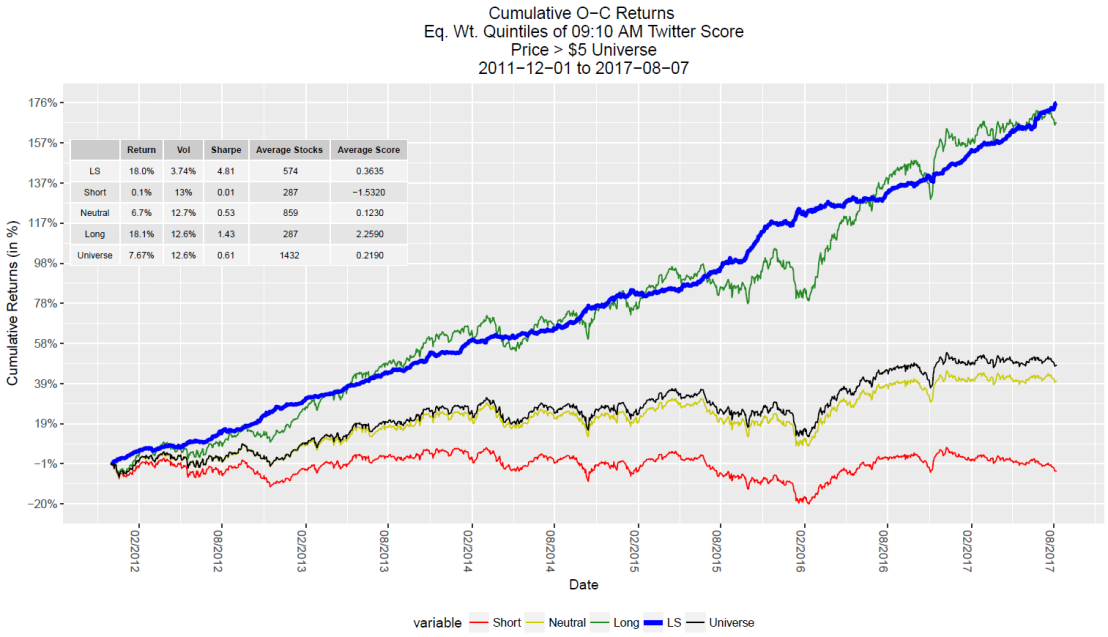

While working at Social Market Analytics, I assisted clients in successfully extracting alpha from alternative data through natural language processing and sentiment analysis. Whether used as the primary dataset or meant to augment an existing strategy, I am familiar with the development process beginning with the initial ingestion of the data to it being the backbone of a live, production model.

To further my financial knowledge, I explore topics of interest on my blog, Quantoisseur. I am guided by a principle that was well-stated in Euan Sinclair’s option trading book which reads, “it is better to deeply understand a simple concept than to have a superficial grasp of a more complex model.” Taking this further, it is necessary to be able to effectively communicate data and its implications, thus my blog serves as a method for me to solidify my understandings of the interactions between mathematics and finance. Additionally, I enjoy projects which allow me to find novel ways to clearly visualize data principles and findings.

MS Applied Mathematics – Columbia University

BS Industrial Engineering – University of Washington

Academic Interests: Numerical Methods, Optimization, Bayesian Statistics, Compressed Sensing, Scientific Computing

Feel free to email me at coltonsmith321@gmail.com or connect with me on LinkedIn.

Can you tell me where I can find the dataset? Thank you!

LikeLike

Hi, you will need to contact StockTwits directly about the dataset.

LikeLike